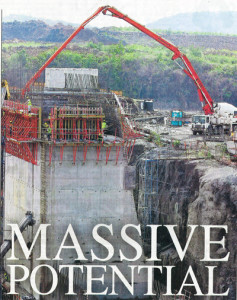

A massive construction project thousands of miles away could be a boost to Northeast Pennsylvania’s economy.

The Panama Canal expansion, when completed in 2014, will expand the capacity of the now fully-booked shipping route from Asia. For years, cargo that couldn’t get through the canal went instead to the west coast where it overburdened those ports. Then freight had to make the expensive journey by road and rail over land.

Once competed, the new locks will allow bigger ships and more cargo through the canal and to Gulf and East Coast ports. Some economic developers and port administrators expect a “canal effect,” an economic boost to port cities with new jobs created as more goods hit land and head to their destination.

While quite a distance from ocean ports, Northeast Pennsylvania, is a logistics hub and may benefit from busier eastern ports.

“The expansion of the Panama Canal will diversify points of entry into the U.S.,” said John Cognetti, president of the Penn’s Northeast, the regional economic development marketing firm. “Everyone is jockeying for position and we need to be ready.”

Ready for what? No one is exactly sure.

Local economic developers and the logistics professionals take a hopeful, yet wait-and-see, stance on how the Panama project will benefit the Pennsylvania economy.

The sector, which includes transportation, warehousing, and distribution, is growing even without the canal, noted James Cummings, spokesman for Mericle Commercial Real Estate. Any impact from the canal could be “icing on the cake.”

“All great roads meet here: we have active rail, foreign trade zones, and investment-grade, high-ceiling industrial space,” Mr. Cummings said. “We are better prepared now for something like this than we have ever been at any time.”

Dick Kane, chief executive officer of Scranton-based logistics firm Kane Is Able Inc., said while the industry expects an influx of freight to the east coast, he’s not sure how it will manifest itself here.

“This is a fantastic development for East Coast shipping in general,” Mr. Kane said. “From a strategic position, Northeast Pennsylvania is very favorably situated.”

Key ports that could have an impact on Northeast Pennsylvania – Philadelphia and New York/Newark – are bracing for huge increases in cargo shipments.

The increases could lead to more jobs in the area and make logistics an even more important sector of the region’s economy. Logistics, which includes shipping, transportation, distribution and warehousing, is one of the largest private employment sectors in Northeast Pennsylvania employing more than 17,000 and could get much bigger.

Fully booked

Goods from Asia make their way to and through North America two ways. Goods headed for the East Coast could go through the Panama Canal while those for the rest of the country could go to the West Coast. As cargo ships grew larger starting in the 1980s, the famous canal has been inadequate for modern shipping.

“The Panama Canal has been obsolete since the 1980s,” said Aaron Ellis of the American Association of Port Authorities in Alexandria, Va.

“The canal will soon be able handle ships three times the size of those going through the canal today.”

The largest ships the canal can accommodate carry just one-third the freight of the today’s vessels. Known as Panamax (Panama maximum) ships, they and carry up to 4,400 shipping containers. The containers, known as TEUs or 20-foot equivalent units, are roughly the size of a standard 20-foot intermodal container, designed to be transferred from ship to train or trailer.

Larger ships, known as post-Panamax, lug 12,600 containers, but are too big for the canal. Same for even larger Super Post-Panamax ships. The bigger the ship, the greater the fuel savings.

Shut out of the canal, Post-Panamax ships have made the ports of Los Angeles and Long Beach the busiest ports in the nation. The trade-off is that goods from Post-Panamax ships to the East Coast is a long, expensive journey. After unloading on the West Coast, cargo makes the journey by truck or train to its destination. With 60 percent of the U.S. population east of the Mississippi – the land bridge can be fast, but also costly.

Third set of locks

The Panama Canal expansion will solve those problems when the new set of locks open to post-Panamax ships.

Those ships will need East Coast ports to unload. So eastern ports scramble to upgrade and avoid becoming obsolete. According to a report in Port Strategy magazine, East Coast ports are spending about $800 million on dredging harbors to 50-feet deep, required to host a fully-loaded post-Panamax ship.

“There’s no question we have to root for the Port of New York,” Mr. Cognetti said.

Operated by the Port Authority of New York and New Jersey, the port finished its navigation deepening project and is focusing its attention on the Bayonne Bridge. A fully loaded post-Panamax ship can make it under the bridge and into the harbor, but, once unloaded it is taller, topping 210 feet, and would not be able to make it out.

The Port Authority is spending $1 billion on an engineering feat: building a new roadway on the Bayonne Bridge that is 50 feet higher than the existing roadway. Enough to allow an unloaded post-Panamax ship to leave the port.

“The Panama Canal project is huge and it will have worldwide implications,” said James R. Brennan, Ph.D., Partner in Norbridge, Inc., a Reston, Va.-based consultant. “This is an extraordinary long voyage, and ships this size make it easier and cheaper than shipping over land.”

The exact impact on the local economy is hard to tell. Yet, inquiries have already come into the Monroe County, said Chuck Leonard, Executive Director for Pocono Mountain Economic Development Corp, relating to the anticipated rush of cargo passing through the Poconos. “These ships are coming our way and we have to consider how we can position ourselves to take advantage of it and whether our communities make the right investments,” Mr. Leonard said. “Even if we don’t see a direct impact of new businesses and spin-off companies, our incumbent firms will benefit.”

The increased shipping activity on the East Coast isn’t just about imports and logistics. It can also be a boon for exports, including those manufacturers who think exporting is too complicated or expensive, Dr. Brennan said.

All those big ships dropping off Asian goods in Philadelphia or New York don’t want to go back completely empty. Domestic producers will be able to take advantage of low shipping rates.

“The company that has been leery about exporting will, or is already, finding opportunities,” Dr. Brennan said. “As they look for back-haul cargo, they will offer sweet deals to companies.”

Contact the writer: dfalchek@timesshamrock.com